Tuition Statements

Overview

Information on this tax form is to assist you in claiming an educational tax credit on your federal income tax return. The Taxpayer Relief Act of 1997 allows students (or taxpayers claiming students as dependents) to claim certain qualified tuition and fee payments as a Lifetime Learning Credit or the American Opportunity Credit.

IRS Tax Form 1098-T is generated for students who:

- Provided the College with a valid social security number

- Paid for qualified charges during the calendar year (January 1 to December 31)

Qualified charges include:

- Tuition

- Mandatory fees

Unqualified charges include:

- Expenses for any course or other education involving sports, games, or hobbies

- Unless the course or other education is part of the student’s degree program.

- Charges and fees associated with room, board, student activities, athletics, insurance, books, equipment, transportation, and similar personal, living, or family expenses

The information on this tax form is furnished to the Internal Revenue Service.

See IRS Forms and Publications for more details. If you didn't receive your 1098-T form, it might have been sent to an old or incorrectly provided address, or you may not have paid qualifying expenses.

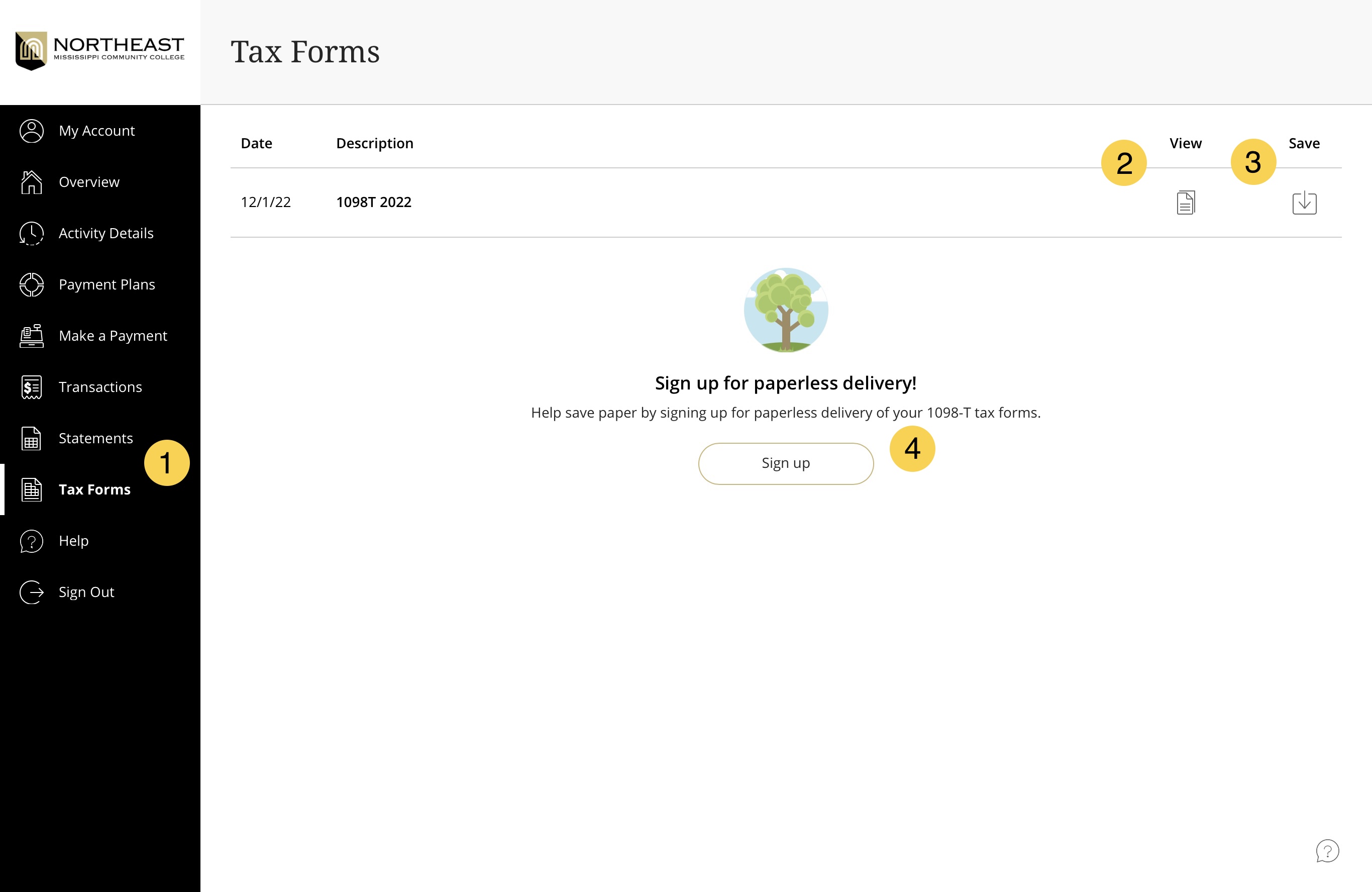

To view your 1098-T

For Tax Year 2022 and later:

To view your 1098-T Tuition Statement, sign in to your student account and follow the steps below.

- Click or tap "Tax Forms".

- Click or tap the "View" icon to view your 1098-T.

- Click or tap the "Save" icon to transfer it to your device.

- If you wish to receive your 1098-T electronically, click "Sign up".

For Tax Year 2021 and prior:

For tax years 2021 and prior, Northeast used Maximus to print and deliver 1098T tax forms to students. If you are looking for a prior year form, please create an account or log in at https://tra.maximus.com.

Why did I not receive a 1098-T?

NEMCC will not issue a 1098-T if any of the following conditions are met:

- Your scholarships and/or grants exceed your qualified tuition and related expenses for the calendar year. This only applies to grants that NEMCC administers or processes.

- You were taking courses for which no academic credit is offered, even if you are otherwise enrolled in a degree program

- Your qualified tuition and related expenses are entirely waived or paid entirely with scholarships.

- Your qualified tuition and related expenses are covered by a formal billing arrangement between an institution and the student’s employer or a governmental entity such as the Department of Veterans Affairs or the Department of Defense.